INTRODUCTION

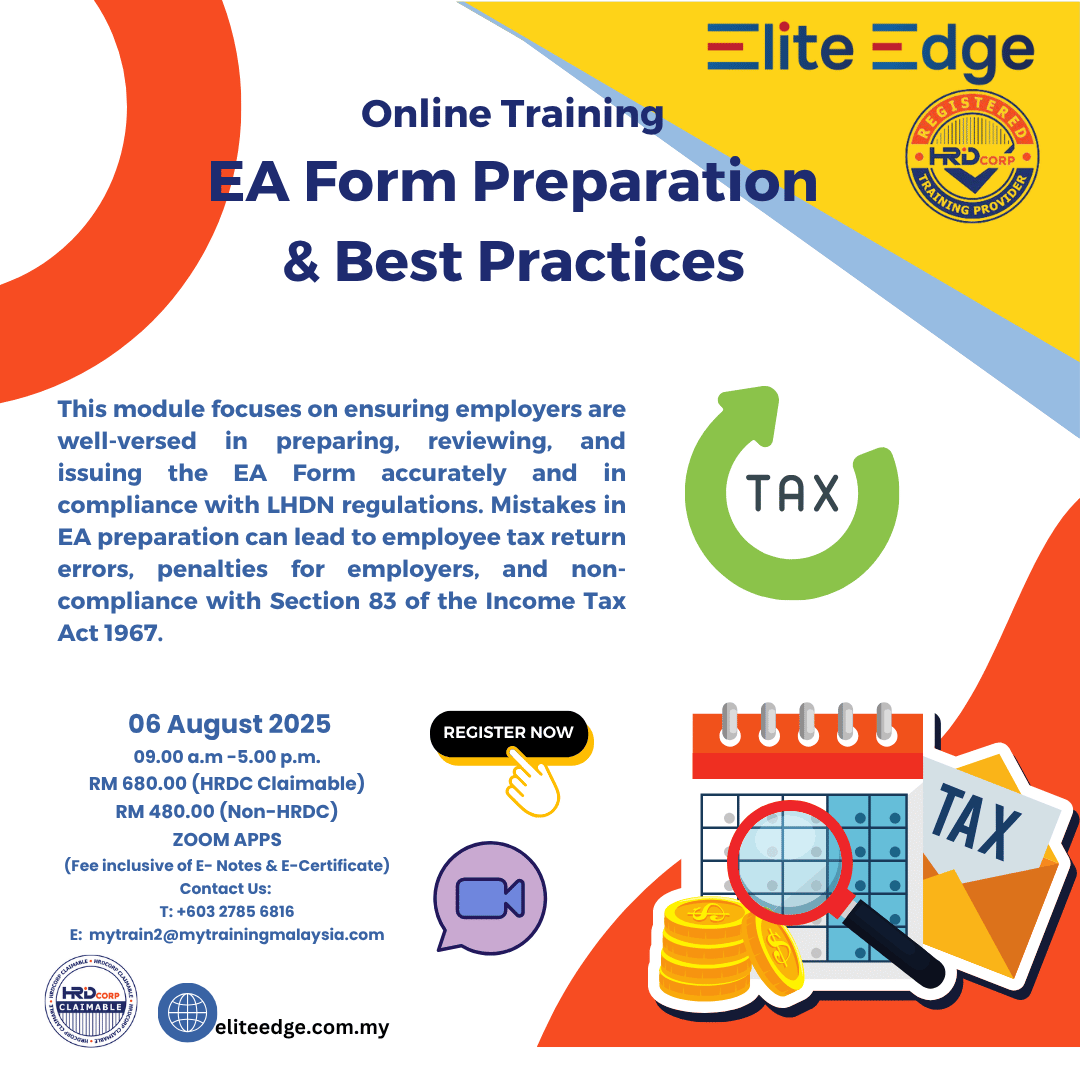

This module provides a comprehensive overview of the statutory requirements and technical processes involved in the preparation, verification, and issuance of EA Forms. Emphasis is placed on ensuring full compliance with LHDN guidelines and Section 83 of the Income Tax Act 1967. Inaccuracies in EA Form reporting may result in erroneous employee tax submissions, regulatory penalties, and employer non-compliance.

LEARNING OBJECTIVE

Upon successful completion of this 1-day training, participants will gain the knowledge and practical understanding necessary to:

Streamline and manage payroll processes efficiently using the e-PCB Plus system

Minimize human errors in PCB (Potongan Cukai Bulanan) calculations

Ensure compliance with tax regulations and avoid potential penalties from the Inland Revenue Board (LHDN)

WHO SHOULD ATTEND?

This workshop is ideal for:

- Payroll executives and HR personnel responsible for monthly salary processing

- Finance and accounting staff involved in payroll tax compliance

- Business owners and SME managers seeking to improve payroll accuracy

- Anyone using or planning to use the e-PCB Plus system for monthly tax deductions (PCB)

- No prior experience with e-PCB is required, but basic payroll knowledge will be beneficial.